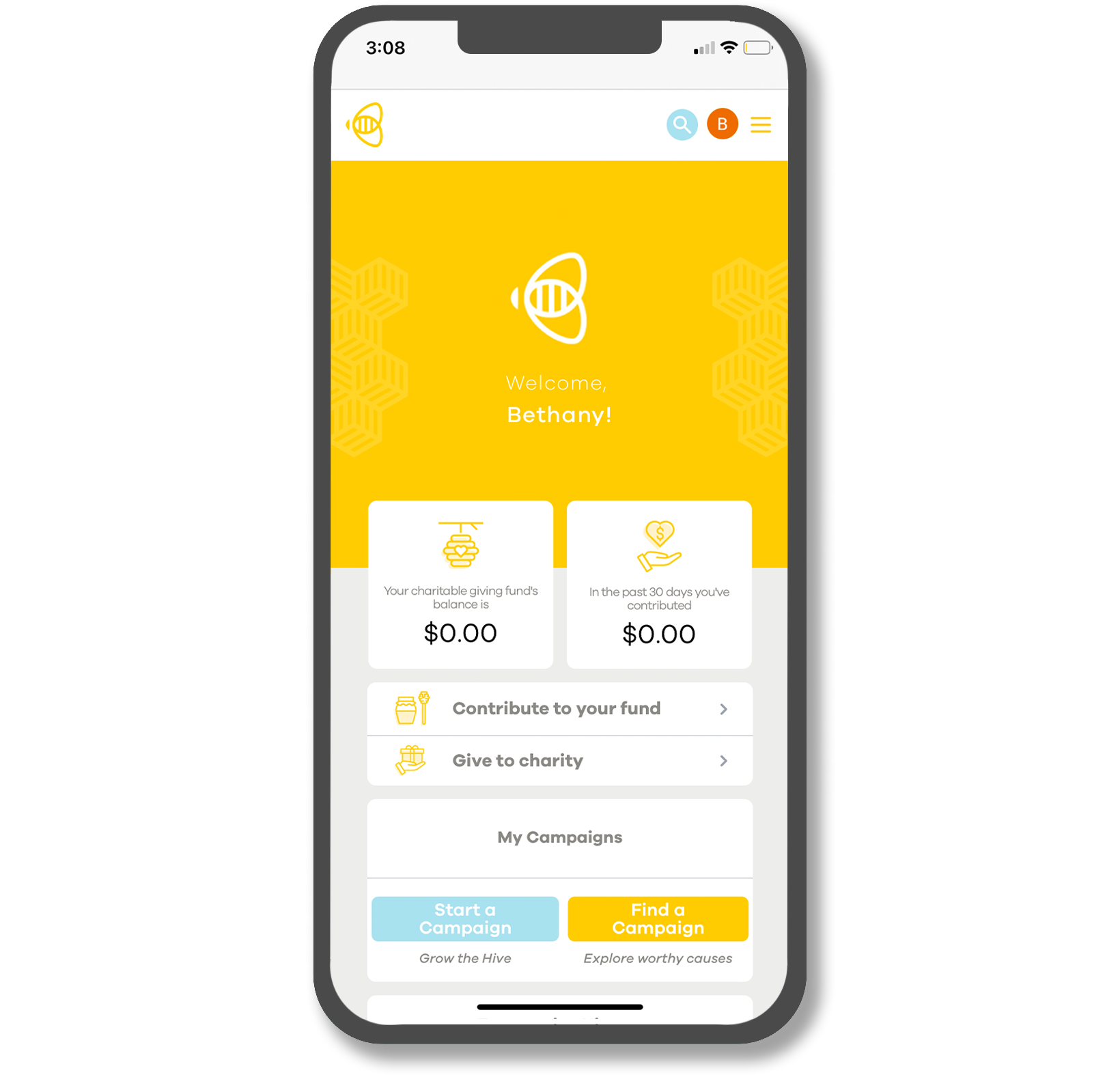

If there are 5 organizations that I care about, and I want to fund them at different times throughout the year, I’m just getting a single receipt from B Charitable and it’s easy for me when I file my taxes.

With just a few clicks, all the causes that we care about supporting as a family can be set up as reoccurring contributions, and I don’t have to worry about if I sent the check… it’s already done.

Generosity is a big part of our family and B Charitable makes it so simple. You can log on, create a campaign, set goals as a family.

How to start your Donor Advised Fund

Step 1:

Create a free donor advised fund by clicking the link below. You can make single or recurring financial contributions to your fund, or set up a campaign directly linked to the charity of your choice.

Step 2:

Grant money from your fund to any public charity whenever it makes most sense to them.

Step 3:

At the end of the year receive one single tax receipt for all of your charitable donations.

GENEROSITY IN ABUNDANCE

“B Charitable feels like it’s bringing giving into the 21st century”

LC and her husband believe that it is important to teach their children the value of giving back in seasons of abundance and B Charitable is helping them do that by bringing the world of charitable giving straight to their phone. This all in one giving platform makes it easy to incorporate generosity into their routine.

A SMARTER WAY TO GIVE

“I would recommend B Charitable because of it’s simplicity”

As someone that has worked in the finance and non-profit worlds for over a decade, Stephen understands the pain points of both giving and receiving charitable donations. B Charitable has allowed him to simplify his personal giving through an all-in-one platform, and still grant funds to the charities he supports whenever it makes most sense for them to receive those funds.

GIVING BACK MEANS MORE

“You can set goals as a family and then at the end of the year you have all your documents in one place.”

Katherine and her husband have made generosity a big part of their family and they want to teach their kids that when you give back it is a way to not only help others, but a way to bring meaning and purpose to the hard work that you do in life. B Charitable has given them a way to not only give to as many charities as they want to support, but it has simplified the process so that everyone can be a part.

What They’re Saying

“A tax-exempt entity whose sole purpose is to house charitable gifting funds for individuals, the platform provides donors with financial peace of mind knowing that the funds collected on B Charitable can only then be donated to public charities. Unlike other crowdfunding platforms and apps, only the individual collecting donations on B Charitable can access the funds… Consciously inclusive of all economic positions, B Charitable is making the intentional giving of the rich available to everyone.”

“The company provides the only platform that harnesses the tax advantages of charitable contribution, in combination with smart technology, crowdfunding campaigns, low fees, performance tracking, and tax-free investment growth.”

A modern donor advised fund, for everyone.

Make Generosity Simple

Establish and name your very own charitable giving fund with just a few clicks. Make a one-time or recurring tax-deductible contribution, set charitable giving goals, and track your fund’s performance through your very own dashboard. Easily give from your fund to over 1.4 million charities when you choose.

Deduct now, donate later

B Charitable, Inc. is a public charity. So you’ll receive a tax receipt immediately upon making a contribution to your own charitable giving fund. You can grow your fund, tax-free, with low-risk investments, and give to any registered non-profit at a time that you choose.

Recruit Your Community

Easily create a crowdfunding campaign to support any public charity. Invite your friends, family, and social network to give alongside you to grow your impact and meet your charitable giving goals.

Donate to charities in a simple, smart, social and secure way.

What is a Donor Advised Fund?

A better solution to Charitable Giving

A donor-advised fund is like a charitable investment account created with purpose of building a charitable legacy and supporting the causes you care about in a simple and smart way. With the help of a sponsoring organization like B Charitable, you can contribute cash, securities or other assets to your own donor-advised fund, and get an immediate tax deduction. You can then make grants registered charities immediately, or allow your fund to grow with tax-free investment avenues.

Traditionally, the donor advised fund has been a tool of the wealthy with a high cost of entry and operation. One of the primary goals of B Charitable is to unlock the powerful advantages of the donor advised fund for everyone, even you. With no minimum contribution requirement, investment growth, and one simple tax receipt, changing the world doesn’t get much easier than this.

What are the benefits of a donor-advised fund?

- Easily contribute funds with one-time or recurring contributions. With just a few clicks, you can make contributions to your fund and set up automatic, recurring contributions with either your card or through ACH transfer.

- Maximize your potential Tax benefits. B Charitable is a nonprofit corporation recognized by the IRS as a public charity. Contributions to your Charitable Giving Fund are non refundable, charitable contributions. As such, contributions to your fund are tax deductible immediately, no matter whether you request that they be granted to other charities immediately or later.

- Invest donations for tax-free growth. If you plan to maintain a balance in your Charitable Giving Fund, you may grow that balance through different investment tools. This investment growth, like the balance of your fund, can ONLY be distributed to other public charities. As such, the growth is tax-free and provides a great way to increase the impact of your contributions.

- Simplify your books with a single account and tax receipt. Easily keep track of every contribution to your fund and any grants you request to charity with one, single tax receipt. You no longer need to keep track of every donation made to charity, just the single receipt from your Charitable Giving Fund contribution.

- Leave a legacy of generosity. B Charitable makes it easy to be intentional with your charitable giving, increasing your impact through the course of your life. B Charitable also gives you the opportunity to name a successor donor(s) on your Charitable Giving Fund. Successor donors assume all privileges after the death of the last account holder, providing an opportunity for your meaningful charitable legacy to be continued.

A Message from our Founder

Setting up your own Charitable Giving Fund only takes seconds and with no minimum contribution, you can immediately start giving to the charities that you care about.

What are you waiting for, world-changer?

It’s time to B Charitable. Set up your own personal giving fund in just a few clicks.